The Hidden Cost of Unsuitable Investments

How a 70-Year-Old Was Sold an Impressive ULIP Until We Looked Deeper.

Sneha Rege

12/25/20254 min read

In personal finance, numbers often hide more than they reveal.

A relative recently shared a story that reminded me how mis-selling doesn’t always look like mis-selling at first glance.

In this article, let me walk you through what happened and the deeper lessons it holds for every saver, retiree, and family member trying to make responsible decisions.

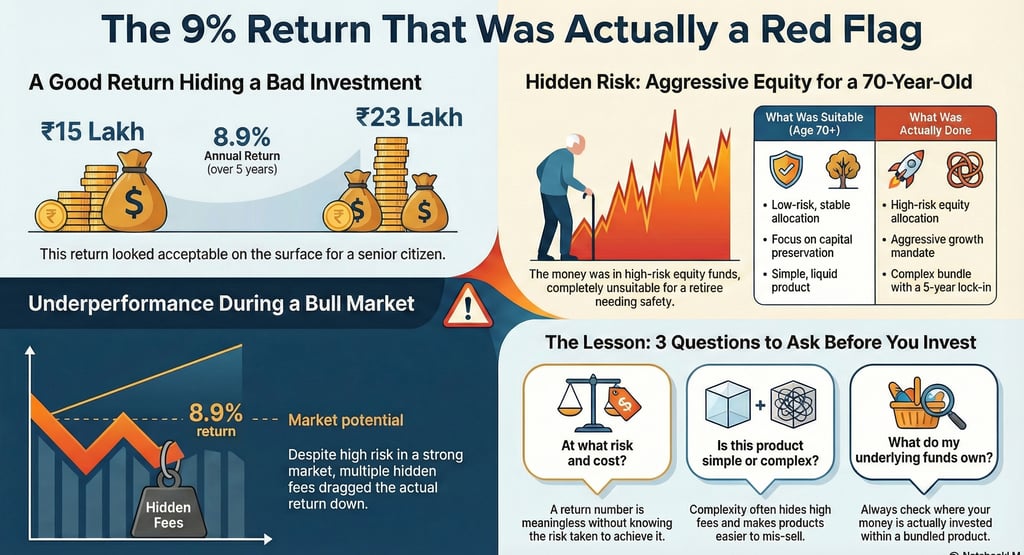

The Pitch: A Simple One-Time ULIP Investment

In 2020, a retired relative, over 70 years old, was approached by a bank relationship manager (RM).

He was sold a Kotak Single Invest Advantage ULIP, marketed as a “one-time, hassle-free, market-linked wealth solution.”

Investment: ₹15 lakh (single premium)

Current value (2025): approx ₹23 lakh

CAGR/XIRR: ~8.9% over 5 years

On the surface, this seems decent.

Many people would look at an 8–9% return and think: “That’s okay for a senior citizen, isn’t it?”

I even paused for a moment. My usual bashing of ULIP’s slowed down and self-doubt creeped in.

But then I checked where the money was actually invested.

That’s where the real story began.

The Cat Comes Out of the Bag: What Funds Were Chosen?

The ULIP brochure listed multiple fund choices, ranging from conservative to aggressive:

Debt funds

Balanced funds

Equity funds

Opportunities funds

Large-cap funds, etc.

For a 70+ year-old retired teacher, one would assume the RM chose something conservative.

At that age, the priority should usually be:

capital preservation

liquidity

low volatility

ease of withdrawal

minimal risk

What the ULIP Actually Invested In

Two aggressive, equity-heavy funds inside the ULIP:

Classic Opportunities Fund – opportunity-style, high-equity, aggressive

Frontline Equity Fund – growth-oriented, large-cap equity, aggressive

Direct Comparison (Clear Mismatch)

What Was Suitable (Age 70+)

Low-risk, stable allocation

Capital preservation

Liquidity-focused

Low-cost structure

Simple products

What Was Actually Done

High-risk equity allocation

Aggressive growth mandate

5-year lock-in

Multi-layered ULIP charges

Complex insurance-investment bundle

A senior citizen unknowingly ended up with an aggressive equity exposure inside a high-cost ULIP.

This is the real problem, not the return number.

This immediately raised red flags.

Why the 8.9% Return Is Actually a Warning Sign

Let’s put this 5-year period into context:

Between 2020 and 2025, Indian equity markets had one of the strongest broad-based rallies in a decade.

Even mediocre, high-cost equity funds delivered double-digit returns.

Large caps, mid caps, small caps — almost everything rose.

Yet this ULIP’s aggressive equity allocation delivered only ~8.9% CAGR.

Even the worst performing Large-cap Fund gave double digits XIRR during this post covid bull run!

Which begs the question: Why?

Here are the likely contributors:

1️⃣ High Cost Structure

Most investors never see the internal charges because they are not shown upfront.

But these costs are the biggest reason the return looks mediocre despite a strong market rally.

Multiple Charges Inside a ULIP

Premium allocation charges

Policy administration charges

Mortality charges

Fund management fees

Discontinuance charges (if you exit early)

When Do These Hurt Most?

In the first few years, where charges are the highest

So even if the underlying equity funds deliver decent returns,

the investor’s net return gets significantly reduced.

This is exactly why the policyholder ended up with sub-optimal performance

not because the markets were poor, but because the product was expensive and unsuitable.

2️⃣ No Transparency & Limited Flexibility

ULIPs often behave like a black box:

difficult to track

unclear cost deduction timeline

lock-in periods

restricted switching

limited liquidity

This means the policyholder rarely knows whether the portfolio is doing well relative to the market, or only appearing to do well because markets are strong.

3️⃣ Misalignment With the Investor’s Profile

A high-equity product may rally in bull markets, but for senior citizens, it introduces:

higher drawdown risk

sequence-of-return risk

illiquidity risk

psychological stress during volatility

Even if returns look fine today, the suitability is fundamentally flawed.

4️⃣ Poor Benchmarking

A return of 23 lakh on 15 lakh (8.9% CAGR) may look satisfying in isolation.

But relative to:

pure equity funds

simple low-cost index funds

even certain hybrid categories

…the performance is underwhelming for the risk taken.

In the same period:

even conservative hybrid funds beat this return

equity funds comfortably exceeded it

index funds delivered much more with lower cost

In other words:

High risk, average reward. Not a good combination.

Why Does This Happen So Often?

Bank RMs are incentivised to sell products that:

give upfront commissions

lock the customer in

reduce redemption risk

look sophisticated

A ULIP fits this perfectly.

But suitability? Risk profile? Post-sale service? Very often, these become secondary.

And for older customers, trust plays a huge role.

If a familiar RM says, “This is good for you,” they rarely question it.

What’s the Lesson Here? (For All Age Groups)

1. Good returns can hide poor suitability.

A number like “8.9%” means nothing unless you ask:

At what risk?

At what cost?

Relative to what?

2. Seniors need capital protection, not aggressive growth.

Aggressive funds inside ULIPs create volatility and stress, often unnecessarily.

3. Product complexity is not a feature.

The harder something is to understand, the easier it is to mis-sell.

4. Always check underlying fund choices.

A ULIP isn’t one product; it’s a basket of funds.

Where the money is placed can completely change outcomes.

5. A second opinion can prevent years of regret.

Sometimes all it takes is one informed person in the family to pause and ask:

“Wait… does this actually make sense for your age and goals?”

A Thought to Leave You With

If even aggressive equity exposure during a strong rally produced only ~9% returns after costs, it tells you something important:

Product design and cost structure matter far more than the sales pitch or the superficial return.

A financial product should serve the investor.

Not the seller.

Not the commission structure.

Not the quarterly sales target.

And especially not at age 70.

sneharege.com

Helping writers and authors in their journey.

Helping professionals in building financial literacy and understanding the fundamentals and behavioural aspects of Retirement planning

for COLLABORATIONS AND consultations.

For more content

contact@sneharege.com

+917083952477

© 2025. All rights reserved.